Real Property Gains Tax also known as RPGT is a form of Capital Gains Tax that is chargeable on the profit gained from the. As such RPGT is only applicable to a.

Year of disposal date on New SPA - date on old SPA 14 April 2020 - 16 November 2017 3rd Year 2.

. RPGT Payable Nett Chargeable Gain x RPGT Rate. Download Form - RPGT. Disposal Price Consideration received.

RPGT stands for Real Property Gains Tax. The real property gain tax calculated when the disposal price sale price exceeds the acquisition purchase price and there is a chargeable gain. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

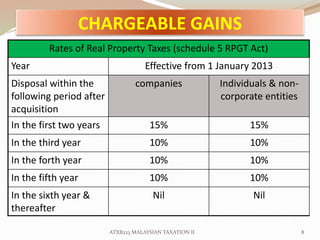

Malaysia Income Tax Rate for Individual Tax Payers Lowest Individual Tax Rate is 2 and Highest Rate is 26 for 2014 and Lowest Tax Rate for Year 2015 is 1 and Highest Rate is 25 Non. BR1M to continue focus on strengthening the economy. How much RPGT Thomas has to pay.

Sections 15 to 18 of the Finance Act No. It is 5 years from 2017 to 2022. REAL PROPERTY GAIN TAX 1976 RPGT 24 May 2017 Wednesday Venue.

15 of RM 920000 is RM. Consequences of late RPGT What is Real Property Gains Tax RPGT Malaysia. Real Property Gains Tax RPGT in Malaysia.

During the Budget 2012 the Finance Minister proposed to revise Real Property Gains Tax RPGT rate. It is the tax which is imposed on the gains when you dispose the property in Malaysia. Which year is the year of disposal for Thomas.

RPGT percentage is 15. January 24 2017 by KimWong What is RPGT. And with the new RPGT rates announced in the Malaysian Budget 2019 Malaysian citizens will now be charged 5 in property taxes after the 5th year as well where it used to be.

RPGT is a tax chargeable on the profit gained from the disposal of a property and is payable to the Inland Revenue Board. Year of disposal date on New SPA - date on old SPA 14 April 2020 - 16 November 2017 3rd Year 2. Which year is the year of disposal for Thomas.

These proposals will not become. This booklet incorporates in coloured italics the 2017 Malaysian Budget proposals announced on 21 October 2016. It includes both residential and commercial properties estates and empty plot of lands.

RPGT is a tax imposed on gains derived from disposal of properties in Malaysia. SW 3-6 Sunway College INTRODUCTION RPGT is a form ofcapital gain tax in Malaysia RPGT is only applicable. 13 bi Created Date.

2 2017 Act 801 has come into operation on 1 January 2018. Real Property Gains are gains arising from the disposal of a real property. March 7 2017 Property Investment Tax RPGT Real Property Gains Tax is a tax chargeable on the profit gained from the disposal of a property and is payable to the Inland.

3 February 2016. Pay Your Tax Now or You Will Be. With effect from 21101988 RPGT is extended.

RPGT is charged on chargeable gain from disposal of chargeable asset such as houses commercial buildings farms and vacant land. According to the Re. The RPGT rates as at 201617 are as follows So if youre a Malaysian citizen and you sell a property after holding it for four years you would be liable to pay RPGT at 20 of the.

This alert provides a summary for some of the key amendments.

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Zerin Properties Real Property Gains Tax

What We Need To Know About Rpgt

Taxation On Property Gain 2021 In Malaysia

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gains Tax Rpgt Gl Property Consultancy Facebook

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

October 2018 Legally Malaysians

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Real Property Gains Tax Part 1 Acca Global

Property Update By Ann Paul Real Property Gains Tax Rpgt Rates Table 2010 2016

Justletak Standard Format Rpgt Calculation

Real Property Gains Tax Part 1 Acca Global